kern county property tax rate

You can use the Texas property tax map to the left to compare Kerr Countys property tax to other counties in Texas. State statutorial regulations require uniform real property market values be established by in-state counties.

Kern County Treasurer And Tax Collector

Kern County Stats for Property Taxes For an easier overview of the difference in tax rates between counties explore the charts below.

. Website Usage Policy Auditor - Controller -. You can also get additional insights on median. Property taxes in Kern County are slightly higher than the.

2019-2020 Annual Property Tax Rate Book. Property Tax Appraisals The Kern County Tax Assessor will appraise the taxable. Visit Treasurer-Tax Collectors site.

Property Tax Rates Report. In Kern County the average property tax rate is 08 making property taxes slightly higher than the state average. This means that residents can expect to pay about 1746.

Tax amounts are determined by the tax rates and values. 2020-2021 Annual Property Tax Rate Book. Who and How Determines Kern County Property Tax Rates.

Stay Connected with Kern County. This law requires that any increase or. Businesses with personal property and fixtures costing in excess of 100000 must file a Business Property Statement.

Senate Bill 813 enacted on July 1 1983 amended the California Revenue and Taxation Code to create what are known as Supplemental Assessments. Taxes - Sample Bill Calculations. The median property tax also known as real estate tax in Kern County is based on a median home value of and a median effective property tax rate of 080 of.

Tax rates are calculated in accordance with Constitutional Article 13a and presented in percentage of value. In Kern County the average property tax rate is 08 making property taxes slightly higher than the state average. The median property tax in Kern County California is 1746 per.

If you need to find your propertys most recent tax assessment or the actual property tax due on your property. For comparison the median home value in Kern County is 21710000. King County collects the highest property tax in Texas levying an.

Tax Rates - Kern County Auditor-Controller-County Clerk. 2018-2019 Annual Property Tax Rate Book. 2021-2022 Annual Property Tax Rate Book.

Statements are due each year by April 1 and a 10 penalty applies for. Tax rates in various countries can be difficult to determine making it difficult to understand what they actually are. The Kern County assessors office can help you with many of your property tax related issues including.

INTERACT WITH KERN COUNTY Contact Us Email Notifications Website Feedback. Payment of Property Taxes is handled by the Treasurer-Tax Collectors office.

Kern County Ca Property Tax Search And Records Propertyshark

Advancekern Kern County Business Recruitment Job Growth Incentive Initiative

Property Tax By County Property Tax Calculator Rethority

Kern County Auditor Controller County Clerk

Kern County Grant Deed Form Fill Online Printable Fillable Blank Pdffiller

Kern County California Archive Case Studies

Kern County Treasurer And Tax Collector

Kern County Assessor Recorder S Office Bakersfield Ca

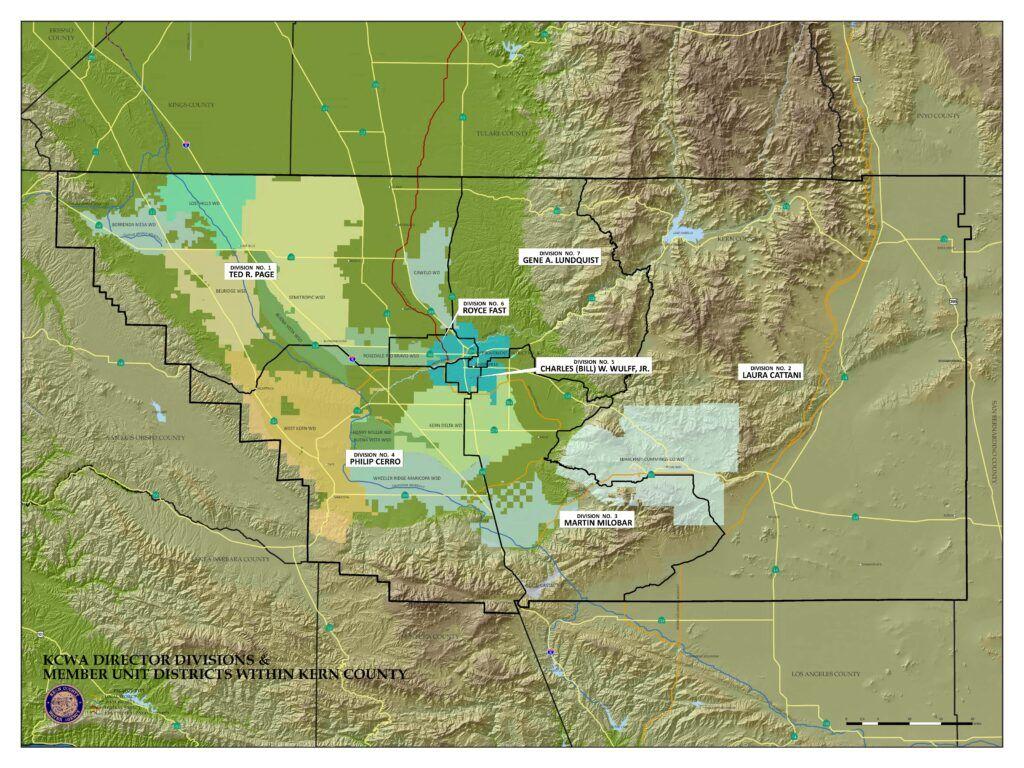

Lois Henry Not So New Newcomer Vies For Seat On Powerful Kern Water Board Lois Henry Bakersfield Com

Property Tax Portal Kern County Ca

Assessor Recorder Kern County Ca

Kern County Treasurer And Tax Collector

Kern County California Wikipedia

Eviction Instructions To The Sheriff Kern County Fill Out Sign Online Dochub

Kern Co Unincorporated Voters To Decide On Sales Tax Hike In November

Medi Cal Kern County Ca Department Of Human Services

County Tax Bills Mailed To Property Owners News Bakersfield Com

New Program Allows Taxpayers Pay Annual Property Taxes In Monthly Installments County Of San Luis Obispo